In this post, I would like to present my analysis on Wonderla Holidays Limited, which is currently an operator of three theme parks in India. I hope the readers would find my work useful.

Understanding the Theme park Industry

Theme parks offer thrill and entertainment to patrons across age groups through a variety of dry and wet rides and other such engaging experiences. Naturally, visiting a theme park being a leisurely activity, demand for theme parks hinges upon discretionary spending of the population. It is widely anticipated that the quantum of discretionary spending in India wound go up enormously in the coming few decades on account of rising prosperity and the demographic structure of Indian population.

Indeed, reports corroborate this idea in the context of the theme park industry. The size of the global theme park industry was Rs. 2.66 trillion in 2016. In comparison, Indian industry measured just Rs. 29.3 billion (almost 1/90 th of the global industry). This looks minuscule when looked at in conjunction with the fact that every sixth human being is Indian! While making such comparisons, we should be aware of the fact that foreign geographies differ drastically from India in terms of infrastructure standards, spending power, size of investments, and regulatory environment. However,directionally I do believe that the industry should grow at a fast clip in the next decade or so.

In India, there are only a handful of large theme parks – some 15 to 20 – for a population of around 1.3 billion. Essel World/Water Kingdom and Adlabs Imagica in Mumbai, Nicco Park in Kolkata and, Wonderla parks in Bangalore, Kochi and Hyderabad are some of the major parks. The following table gives a summary of major parks in India.

Globally, theme parks derive 55% of their revenue from non-ticketing income, which includes customers’ spending on food, beverages and merchandise. The rest is earned in the form of access/entry fees. In Indian context, the non-ticketing income forms just 25% of theme parks’ revenue. This trend too presents an opportunity to the industry, to capitalize on the increasing willingness of the visitors to spend.

As is the case normally, the prospects of growth have started attracting investments in this sector. Setting up an amusement park is an expensive affair owing to the real estate costs involved and the investments towards designing and building fancy rides. Once the park is set up, it has to go through several years of gestation period in which the management has to spend heavily on promotions to bring the footfalls to an optimal level and stabilize several aspects of operations.

It is important for park owners to keep investing in the parks to add new attractions in order to make a visit worthwhile for repeat customers, which form over 30-50% of total customers every year for major parks.

Thus the cost incurred at the time of setting up the park weighs the most on the economic success of it. And, it is in this regard that Wonderla Holidays differentiates itself from its peers.

What is special about Wonderla Holidays Limited?

Wonderla Holidays Limited is the largest theme park operator in India, measured by footfalls. The promoters of the company set up the first park in Kochi in the year 2000, which was named as Veegaland. The park was subsequently renamed as Wonderla Kochi in 2008. The company established its second park in Bangalore in the year 2005 and its third park in Hyderabad in the year 2016. Currently, the Bangalore park is the largest one in terms of footfalls and size.

Thus, the promoters have a fairly long track record in setting up and successfully running theme parks. In fact, Wonderla is the only large theme park chain in India that has parks at multiple locations. These parks also seem to be providing satisfactory experience to their visitors, which reflects in the fact that travel experience websites like Tripadvisor have consistently ranked Wonderla parks as some of the best in India.

Wonderla’s management is focused on providing a thrilling and economical experience to the audience which is willing to pay Rs. 4,000 – 5,000 for a one-day family outing. While peers like Essel World and Adlabs charge visitors separately for entry to their amusement and water parks, Wonderla has a single ticket to its parks that offer both dry and wet rides, thereby providing a lot of value for money for visitors. Surely, setting up such parks must require significant investments.

According to the management, the cost of setting up a theme park for Wonderla is much lower than that for its competitors. This is because Wonderla has its own manufacturing unit in Kochi from which it sources around 30% of its rides. Besides, they also have an in-house engineering team that is entrusted with the erection and maintenance of rides, resulting in significant savings. Even the rides purchased by the company are actually old rides procured from amusement parks abroad. These are refurbished by the company’s internal team to make them safe and fit for use in the parks.

Mr. Arun Chittilappilly, the Managing Director of the company spoke about this unique ability during multiple post-result conference calls.

Q2-FY2017 Earnings call; October 28, 2016:

“I will answer that question, so I think our ride manufacturing is pretty advanced in the sense we can make a lot of rides, but the typical thing that we do is we build slightly simpler rides, evergreen kind of rides like a Ferris wheel or a carousel, those kinds of rides that is what we build inhouse and that contributes roughly about 30%. So, 30% of all the rides in all our parks are usually made in-house, can we build a recoil like ride. I do not know because I do not think it is worth it, the design cost and manufacturing cost or something like that is so huge. I think we will not have any cost advantage and I think we are already getting a good deal because we do not buy new even like a big roller coaster, we buy slightly used and I think we are already trying to take care of our price advantage there.”

Q4-FY2017 Earnings call; May 25, 2017:

“but definitely benefit in the sense, for us, cost of acquisition of rides is very low. Even if we buy a ride from outside because we are able to buy refurbished rides which other players will not be able to do because of the risky nature of the proposition. We use our in-house team to actually refurbish our own machines also. So that if you are able to do and we have already managed to do in many, many cases we have done it. In fact, all the three roller coasters that we bought for our Parks are all refurbished and come at roughly a 50% discount compared to what if we were to buy them new. So that advantage we will continue to get.”

It would be interesting to see if the numbers narrate the same story. A good way to ascertain whether a company is indeed able to build revenue generating assets at lower costs than its competitors is to examine its fixed asset turnover ratio (FATR) over the years and compare it with its peers.

It can be seen that Nicco parks dominates the comparison. This is chiefly due to the facts that Nicco operates the park on a leasehold land and that it is a 27-year old park, which means the assets were acquired at cheap valuations. Besides, it is categorized as a medium sized park on the basis of the kind of footfalls it attracts, whereas Wonderla and Adlabs offer a more exhaustive experience.

Between Wonderla and Adlabs, the former fares much better. In fact, the disparity is huge.

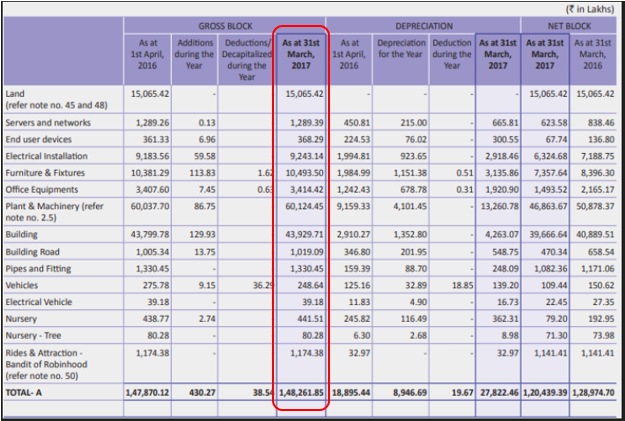

Examining the fixed asset break-up of the two companies can help us understand better.

Source: Wonderla Holidays Limited’s Annual Report 2017

Source: Adlabs Entertainment Limited’s Annual Report 2017

At the end of FY2017, the gross fixed assets (proxy for total investments) for Wonderla Holidays stood at Rs. 495 Crores, whereas those for Adlabs stood at an enormous value of Rs. 1482 Cr. The difference becomes more striking when looked at in conjunction with the fact that Wonderla operates three parks in three different locations, with a cumulative footfall of ~ 2.5 million while Adlabs runs an amusement park and a water park located on adjoining land parcels, with footfalls of ~ 1.7 million.

A part of the humongous difference is explained by the fact that Wonderla’s parks in Kochin and Bangalore are older than the Adlabs’ Park, and therefore the acquisition value for assets in Wonderla’s parks is much lower.

Source: Wonderla Holidays Limited’s Annual Report 2014

For instance, looking at fixed assets schedule in the annual report of Wonderla for FY2014, the year in which the land parcel for the Hyderabad park was procured, it can be established that the company was able to acquire the land parcels for its Bangalore and Kochi parks for a total value of just Rs. 44 Cr (as depicted in the opening gross block for the year). Whereas the purchase of land in FY2018 for the company’s forthcoming park in Chennai cost it over Rs 70 Cr. Thus, these land parcels were acquired when real estate was not as expensive as it is today.

Wonderla was able to set up its new park in Hyderabad, which was commissioned in FY2017, for a total investment of Rs. 250 Cr. Its park in Chennai is being planned to be constructed for an investment of Rs. 350 Cr. In comparison, Adlabs’ park in Khopoli, near Mumbai, came up at a massive investment of ~ Rs. 1500 Cr. Of course, one can argue that Adlabs’ park is much bigger, but the difference in the amount of money being invested by the two companies in setting up parks clearly indicates that Wonderla is able to build its parks at much lower investments. Simply put, investment/footfall for Wonderla is significantly less than that for its competitor, which helps Wonderla price its entry fees attractively even while remaining profitable.

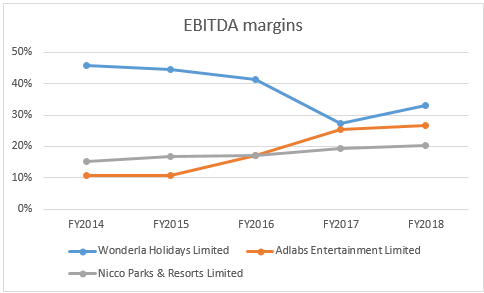

Further, Wonderla performs significantly better than competition when it comes to operating margins, indicating high operating efficiencies.

While making this comparison, we have to allow for the fact that newly opened parks have lower operating margins due to sub-optimal footfalls and high marketing expenses. Wonderla, on account of having two established parks, gains an advantage over Adlabs, which is a relatively new park. Wonderla itself has been going through a phase of low operating profitability in the last two years as can be seen in the graph, because its new park in Hyderabad is in nascent stages.

Overall, it can be said that Wonderla has a unique ability of setting up parks with low investments and running them very efficiently. The combination of high FATR and operating margins has enabled the company to earn high returns on capital employed and remain completely debt free. The company could generate an average RoE of over 18% in the period between FY2013 and FY2017, which is impressive.

What’s more, these profits translated into strong cash flows as the business requires scanty working capital investment. Cumulative Cash flows from operations (CFO) for last 10 years stood at Rs. 439 Cr, dwarfing the cumulative PAT of Rs. 297 Cr in these years. However, operating cash flows have not resulted in free cash flows in the past. Cumulative Free cash flows to the Firm (FCFF) amounted to minus Rs. 45 cr in the last five years. This is because the company has been consistently investing in setting up new parks and enhancing the existing ones. Simply put, the business model is rather capital intensive. But are these continuous investments generating superior returns? Are the new parks likely to generate high returns on capital investments, considering the inflated costs of setting up a park?

In the investor conference call held to discuss Q4-2018 results, the management mentioned that the replacement cost for each park was Rs. 350 Cr. Indeed, the planned park in Chennai is expected to devour a similar investment. In FY2016, when Wonderla was operating mature parks in Bangalore and Kochin, with negligible influence of the upcoming Hyderabad park on its profitability, the company generated a post-tax operating profit (EBIT minus tax) of about Rs. 45 Cr. We can safely assume that the Bangalore park must have contributed around Rs 25 Cr. Assuming that all the parks, after reaching stability, would behave like the one in Bangalore, and allowing for inflation, it would be safe to say that post tax operating profit cannot be much higher than Rs. 35 Cr per annum in today’s rupee value, translating roughly into post-tax ROCE of around 10%. The returns on incremental capital don’t look amazing. A healthy growth in spending per visitor and higher footfalls can significantly improve the scenario though. These two developments will hold the key to future capital efficiency of Wonderla.

It will also decide whether it can continue expanding to new locations while maintain healthy return ratios. Currently, Wonderla is the only player in the industry that has the balance sheet strength to expand. The management of the company seems focused on the goal and is attempting to set up a new park every 2-3 years. Also, it is conservative enough to plan one new park at a time to keep the debt levels in control.

What can go wrong in the story?

As Charlie Munger has emphasised again and again, it is important to invert the problem at hand and think what can go wrong with our hypothesis. Turns out there are significant obstacles in the way of the company.

Source: Annual reports and investor presentations of Wonderla Holidays Limited.

Wonderla’s mature parks in Bangalore and Kochi have been grappling with dwindling footfalls for past few years. The graph above indicates that footfalls in the Bangalore park have declined from 1.2 million in FY2014 to 0.5 million in FY2018, while those in Kochi have slipped from 1.1 million to 0.9 million in the same period. The decline of footfalls is steady across the years indicating the issue may be structural rather than an isolated event.

To be fair, the business has encountered some adverse developments in this period. The biggest of them is introduction of service tax for theme parks in June 2015 causing the effective tax rate for consumers to increase from 3% to 15%. Further, when GST was implemented in July 2017, theme park industry was put in the 28% bracket and was later shifted to the 18% bracket in January 2018. The result of escalation in tax rates, which was completely passed on to the visitors, resulted in making a visit to the parks increasingly expensive for them. According to the management, frequent revision in ticket prices deterred more people from visiting the parks.

Q2-FY2018 Earnings call; November 16, 2017

Analyst: Good afternoon Sir. Thank you so much for this opportunity. I had a little bit of a more structural question. Trying to understand in terms of the trend, if I see the last three-four years now, the total footfalls have actually been just coming down like for example if we just see the first quarter even in FY2015 way back almost three-four years Bengaluru had almost 460,000 footfalls in 1Q, which is really the big quarter for you and Kochi at 304,000 and from there on it is now almost come down to 3.5 lakhs in Bengaluru and Kochi 231,000, so can you explain a little bit what is this trend? Actually we would have thought that because of consumerism, all of that over a period of three-four years we should see some growth and I am not talking about like one or two years, it is almost a four-year trend that every year we are seeing the deceleration?

Arun Chittilappilly: I told you right that is because in 2015 the average tax that a customer paid for a Wonderla park was only 3% then in 2015 June that tax became 15% because we have to pay service tax, then again when GST happened in 2018, so three times the tax rates have changed for a customer, so our net realization even though remaining the same, the outflow from a customer has dramatically gone up in the last three years, so you will see the footfall drop coming only 2015 onwards till then it was going up.

Apart from the tax matter, the management has, from time to time attributed underwhelming footfalls to external situations such as slowdown in the IT industry (Bangalore being a major IT city), disruptions caused by Kauveri river dispute, vagaries of weather, traffic congestions limiting attendance from nearby cities etc. Some of these circumstances were transient in nature, however their recurrence in future can certainly not be ruled out.

Besides, the company has to keep investing in existing parks to attract visitors, about 50% of which happen to be repeat visitors. In fact the quantum of investments can escalate materially as the parks grow old. In Q1-2017, the Kochi park witnessed a steep decline of 24% in footfalls, which was attributed to the park becoming old.

Arun Chittilappilly, Q1-2017 Earnings call, August 03, 2016

To add to that, I think Kochi Park has, so this year we had 2-3 issues one is price hikes and the other issue that came up was that our Park is lightly seen as an old Park. It’s already 16years old. So it need a bit of refresh. I don’t think we become late in doing that infact in any kind of investment for e.g. in Cochin we have to do a Roller Coaster it’s a 25 to 30 crore investment so unless it really needed we don’t want to do it.

It is rather crucial that the existing parks continue to deliver and show moderate growth in attendance. Otherwise, the new parks will only compensate for the underperformance of old ones.

Setting up new parks too has been an onerous task for the company. Wonderla’s Chennai park was planned to be operational in FY2019. However, the acquisition of land for the park was delayed by a year or so. Further, the land deal was closed in Q1-2018, but the work is yet to begin on account of local tax related uncertainty.

Q2-FY2018 Earnings call; November 16, 2017

Arun Chittilappilly: We do not have any clarity right now, in fact, we are trying to work on that issue because we do not think it is viable for us to run park if there is LBT tax which comes on top of GST. So in fact one of the reasons why we have delayed Chennai by a quarter is to have some clarity on that.

The company may face many such roadblocks while executing its strategy of becoming a pan-India player.

To summarize, the developments on the above mentioned fronts should be closely monitored by the investors as they can hugely alter the course of the company.

How attractive are the valuations?

At the CMP of Rs. 331 per share, the company is available at an enormous P/E multiple of 49. However, the multiple is somewhat misleading, as the company is currently navigating through a period of suppressed profitability due to the newly launched Hyderabad park. The P/E multiple using the three year average PAT too stands at 39, which is nowhere close to mouthwatering. But is P/E multiple the right valuation yardstick for the company?

We know that the assets of the old parks in Bangalore and Kochi are fully depreciated. Yet, they are certainly functional! This signals to the fact that there is a significant variance between the actual depreciation of assets and the accounting depreciation recorded in the Profit and Loss statements. Thus, the reported PAT does not accurately represent the earning potential of the company.

| Financial Year End | 2012 | 2013 | 2014 | 2015 | 2016 |

2017 |

| Gross Block Items (in Cr) | ||||||

| Free hold land | 20 | 44 | 46 | 46 | 49 | 49 |

| Buildings | 54 | 58 | 61 | 62 | 63 | 139 |

| Plant & Equipment | 107 | 110 | 115 | 124 | 142 | 241 |

| Electrical Equipment | 12 | 13 | 15 | 16 | 17 | 36 |

| Total Gross Block | 206 | 240 | 253 | 267 | 293 | 490 |

| Net Block | 120 | 143 | 144 | 139 | 152 | 322 |

| Deletetion/Disposal | 1 | 2 | 4 | 3 | 1 |

Source: Annual reports of the company.

Looking at the fixed assets’ position of the company over the last few years confirms the notion. The total gross block has moved from Rs. 206 Cr on March 31, 2012 to Rs. 490 Cr on March 31, 2017, translating into capital expenditure of Rs. 295 Cr. over these 5 years. Out of this expenditure, Rs. 250 Cr were spent on setting up the Hyderabad park, which was commissioned in early FY2017. Thus, the remaining Rs. 45 Cr can be attributed to the maintenance capex. In the same period, the cumulative depreciation reported in the P&L of the company was Rs. 85 Cr. Thus, the average maintenance capex was around Rs. 9 Cr, while average depreciation was Rs. 17 Cr!

Here, it would be pertinent to use the concept of Owners’ earnings made popular by eminent investor Warrant Buffet. It is a simple metric that helps us to calculate the amount of cash that can be drawn out by the equity holders annually, which can then be used to value the company.

In the 1986 Berkshire Annual Shareholder Letter Buffett outlined his thoughts on owner earnings.

“If we think through these questions, we can gain some insights about what may be called ‘owner earnings.’ These represent (a) reported earnings plus (b) depreciation, depletion, amortization and certain other noncash charges such as Company N’s items (1) and (4) less ( c) the average annual amount of capitalized expenditures for plant and equipment, etc., that the business requires to fully maintain its long-term competitive position and its unit volume. (If the business requires additional working capital to maintain its competitive position and unit volume, the increment also should be included in (c). However, businesses following the LIFO inventory method usually do not require additional working capital if unit volume does not change.)” – Warren Buffet

In short, if we calculate owner earnings for Wonderla, we will arrive at the amount of money that will be available to the shareholders from the existing three parks after deducting the capital expenditure required to maintain the long term competitive position of the company. We should be cognizant of the difference between maintenance capex and the total capex of the company. Wonderla being a growing company, the former would be much less than the latter.

Owner earnings is a more accurate replacement for reported PAT while calculating the P/E multiple for evaluating the attractiveness of valuation. Since, companies declare only the total capital expenditure incurred by them in a particular year, we are left with the ambiguous task of segregating maintenance capex from the total capex.

In the above calculations, we have seen that the average maintenance capex from FY2013 to FY2017 was around Rs. 9 Cr. With the recent addition of the Hyderabad park and potential increase in maintenance of ageing parks, we can safely assume this figure to be in the range of Rs 20 – 25 Cr for the coming few years. In FY2016, the Bangalore and Kochin parks together generated cash flow from operations (CFO) of Rs. 73 Cr. Once the Hyderabad park gets stabilized, which should happen in a couple of years, the combined CFO of the three parks could be in the proximity of Rs. 100 – 110 Cr. Subtracting the estimated maintenance capex from the estimated CFO, we arrive at the approximate owner earning of Rs 75- 90 Cr. This is an approximate value unlike the reported PAT. But as John Maynard Keynes famously said, “ It is better to be roughly right than precisely wrong”

At the time of writing this post, Wonderla has a market capitalization of Rs. 1875 Cr, which is 20-25 times the owner earnings as estimated above. The valuation seems less outrageous from this perspective! However, to justify it, Wonderla will have to show concrete evidence of revival in footfalls in older parks along with healthy growth in revenue per visitor. Beyond that, a relatively glitch-free progress in setting up new parks – in Chennai currently and other cities in future – would be the main source of value creation for the shareholders.

Very nicely written article. It shows the efforts. Specially liked the point where the depreciation is shown more that the capex occured by company showing Management efficiency.

LikeLike

Thanks Ajinkya!

LikeLike